Ma Tax Brackets 2025. Massachusetts tax law changes for 2025 and 2025. The calendar officially flipped to 2025 at midnight on monday and that meant a new tax law would take effect in massachusetts.

Each marginal rate only applies to earnings within the applicable marginal tax. 4% surtax on taxable income over $1,000,000.

Tax brackets 2019 vptiklo, Marginal tax rates won’t change in 2025. Massachusetts tax law changes for 2025 and 2025.

Here are the federal tax brackets for 2025 vs. 2025 Narrative News, Percentage method tables updated to include 4% surtax. 2025 federal income tax brackets and rates in 2025, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1).

Understanding 2025 Tax Brackets What You Need To Know, The lowest rate will remain 10 percent, and the highest will still be 37 percent. Best credit cards for bad credit.

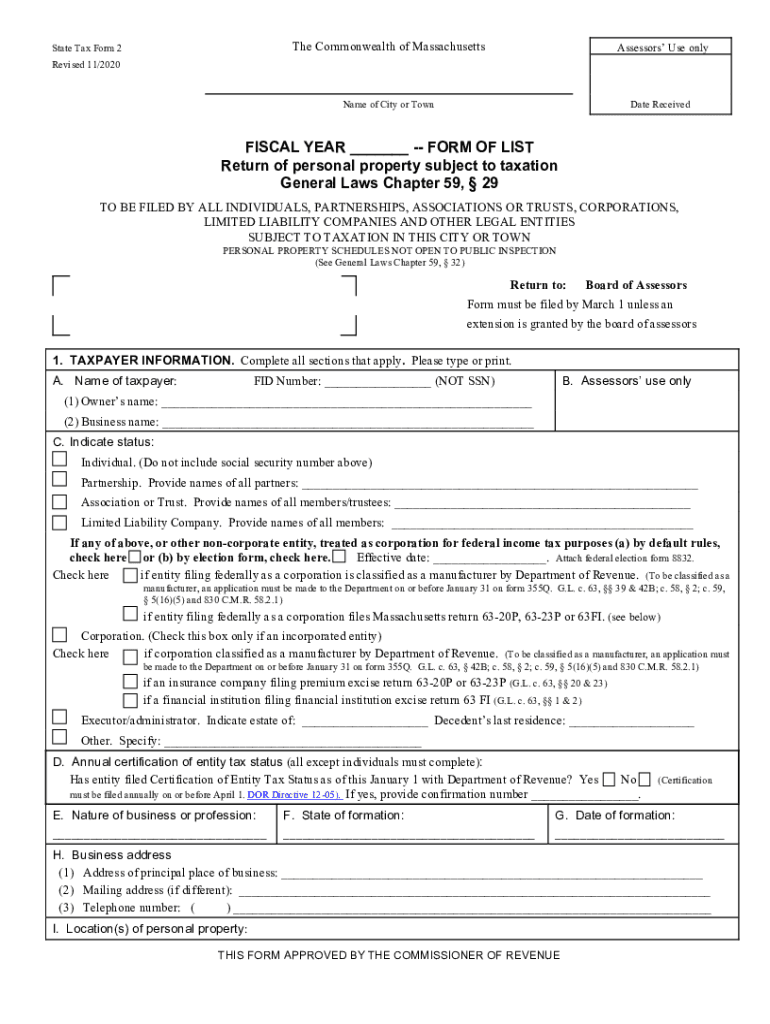

20202024 MA State Tax Form 2 Fill Online, Printable, Fillable, Blank, Best credit cards for bad credit. The irs issued a press release describing the 2025 tax year adjustments that will apply to income tax returns.

Tax Brackets for 20232024 & Federal Tax Rates (2025), Marginal tax rate 22% effective tax rate 10.94% federal income tax $7,660. Massachusetts state income tax tables in 2025.

Tax filers can keep more money in 2025 as IRS shifts brackets The Hill, The irs issued a press release describing the 2025 tax year adjustments that will apply to income tax returns. The lowest rate will remain 10 percent, and the highest will still be 37 percent.

IRS Updates Tax Brackets for 2025 Canon Capital Management Group, LLC, Tax relief worth hundreds of millions of dollars is coming. Each marginal rate only applies to earnings within the applicable marginal tax.

Wadidaw 2025 Tax Brackets Irs Ideas 2025 CGM, Hear all about what’s new this tax season, including the new child and family tax credit, enhancements to the earned income tax credit and senior circuit breaker credit,. Currently the two highest income brackets are taxed at 37% for incomes over $578,125 and.

Inflationadjusted Tax Brackets for 2025 Thompson Greenspon, New for the 2025 filing season, an additional 4% tax on 2025 income over $1 million will be levied, making the highest tax rate in the state 9%. Federal lottery taxes are determined by the income bracket the winnings fall into.

2025 tax brackets how the new tax brackets affect your bill, The state also has a flat statewide sales tax rate of 6.25%. Massachusetts has a flat income tax rate of 5%, but charges a 4% surtax on income over $1 million.